3 Easy Facts About Paul B Insurance Described

Table of Contents9 Simple Techniques For Paul B InsurancePaul B Insurance for BeginnersAn Unbiased View of Paul B InsuranceThe 6-Second Trick For Paul B InsuranceThe Buzz on Paul B InsuranceThe Paul B Insurance Diaries

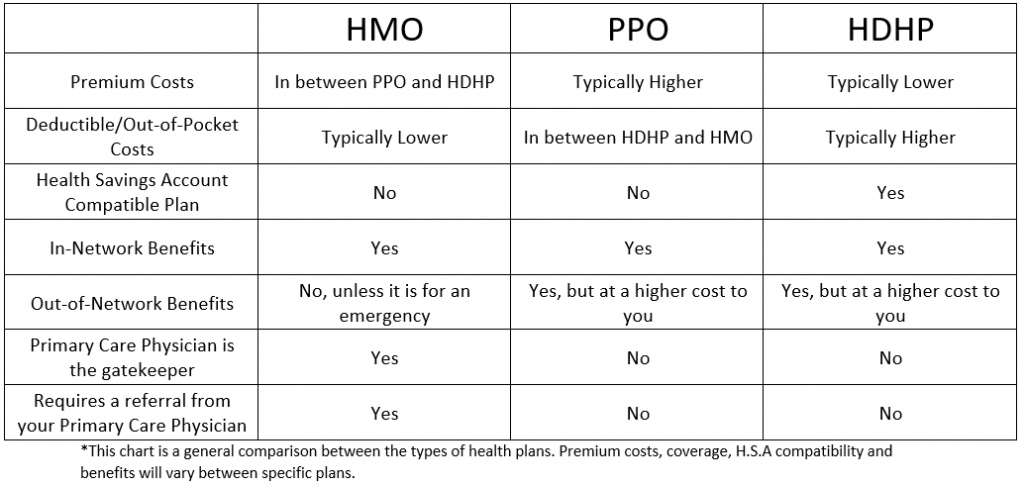

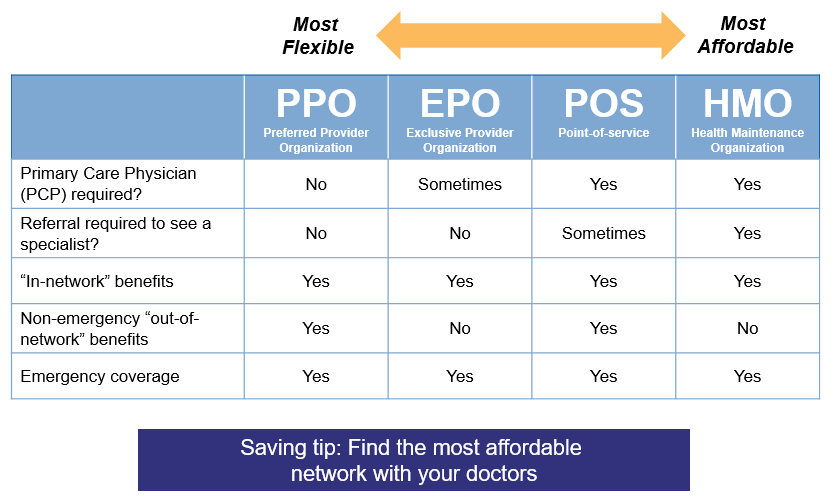

Associated Topics One reason insurance policy issues can be so confounding is that the medical care market is constantly transforming and the protection intends offered by insurance firms are tough to classify. In other words, the lines in between HMOs, PPOs, POSs and also other kinds of coverage are typically blurry. Still, comprehending the makeup of numerous plan types will certainly be handy in examining your alternatives.

Once the deductible quantity is gotten to, extra wellness costs are covered based on the stipulations of the health and wellness insurance coverage plan. A worker may after that be liable for 10% of the expenses for care received from a PPO network carrier. Deposits made to an HSA are tax-free to the employer and worker, and also cash not invested at the end of the year might be rolled over to pay for future medical costs.

Paul B Insurance Things To Know Before You Get This

(Company payments have to be the exact same for all workers.) Employees would certainly be in charge of the very first $5,000 in medical expenses, but they would certainly each have $3,000 in their personal HSA to pay for medical expenses (and would have also extra if they, also, contributed to the HSA). If workers or their family members tire their $3,000 HSA allocation, they would certainly pay the following $2,000 out of pocket, whereupon the insurance plan would certainly start to pay.

(Certain restrictions might put on very compensated participants.) An HRA has to be funded only by an employer. There is no limit on the quantity of money a company can add to staff member accounts, nevertheless, the accounts may not be moneyed via staff member wage deferrals under a lunchroom plan. Furthermore, employers are not permitted to reimburse any component of the balance to employees.

Do you understand when the most remarkable time of the year is? The wonderful time of year when you get to compare health insurance coverage intends to see which one is right for you! Okay, you obtained us.

The Best Guide To Paul B Insurance

When it's time to select, it's vital to know what each strategy covers, how much it costs, and where you can use it? This things can really feel complex, but it's simpler than it seems. We created some useful understanding actions to assist you feel great regarding your options.

(See what we did there?) Emergency care is usually useful link the exception to the regulation. These strategies are the most preferred for individuals who get their health and wellness insurance coverage via job, with 47% of covered employees enlisted in a PPO.2 Pro: Most PPOs have a good selection of service providers to select from in your location.

Disadvantage: Greater premiums make PPOs much more costly than other types of plans like HMOs. A health care organization is a health and wellness insurance coverage strategy that usually only covers care from doctors who benefit (or agreement with) that specific plan.3 Unless there's an emergency, your plan will not pay for out-of-network care.

The smart Trick of Paul B Insurance That Nobody is Discussing

Even More like Michael Phelps. It's excellent to recognize that strategies in every group give some kinds of totally free preventative care, and also some offer totally free or affordable health care services prior to you fulfill your insurance deductible.

Bronze strategies have the most affordable regular monthly premiums however the highest possible out-of-pocket costs. As you work your way up with the Silver, Gold and Platinum categories, you pay more in costs, however much less in deductibles and also coinsurance. As we stated before, the extra prices in the Silver category can be minimized if you qualify for the cost-sharing reductions.

Getting My Paul B Insurance To Work

When selecting your medical insurance plan, do not fail to remember about medical care cost-sharing programs. These work rather much like the other medical insurance programs we defined currently, however technically they're not a kind of insurance. Allow us to discuss. Health and wellness cost-sharing programs still have month-to-month premiums you pay and defined coverage terms.

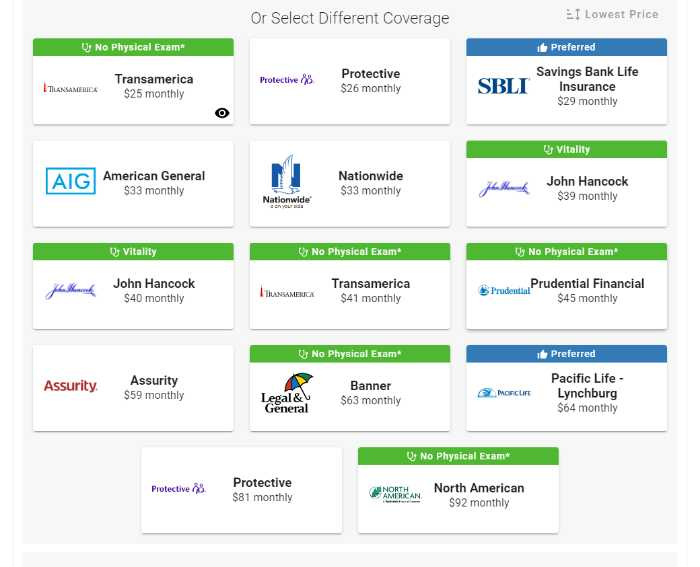

If you're trying the do it yourself course as well as have any kind of lingering concerns about health and wellness insurance strategies, the specialists are the ones to ask. As well as they'll do greater than just answer your questionsthey'll also locate you the very best price! Or perhaps you 'd like a means to integrate obtaining great health care coverage with the opportunity to aid others in a time of demand.

Not known Incorrect Statements About Paul B Insurance

CHM aids families share health care expenses like medical tests, pregnancy, hospitalization and also surgical procedure. And also, they're a Ramsey, Trusted companion, so you recognize they'll cover the clinical expenses they're supposed to as well as recognize your protection.

Key Question 2 Among the things wellness care reform has done in the united state (under the Affordable Treatment Act) is to introduce even more standardization to insurance coverage plan advantages. Before such standardization, the benefits supplied different substantially from plan to plan. Some strategies covered prescriptions, others did not.